CDFA Tax Credit Program

We did it!!

As of January 2024, all $400K of the tax credits awarded to Visions Hanover by the NH Community Development Finance Authority (CDFA) have been purchased! We are so very grateful to every single one of the local businesses listed below that have participated in this opportunity.

Be sure to thank them for supporting our mission!

CDFA tax credits allow businesses to fund qualifying economic or community development projects in exchange for a tax credit that can be applied against state business tax payments. The tax credits are administered by the New Hampshire CDFA.

Any business with operations in New Hampshire that contributes to a CDFA tax credit project receives a New Hampshire state tax credit worth 75 percent of their contribution.

The credit can be used over a period of five years to reduce the business’ state tax liability (business profits, business enterprise, or insurance premium taxes).

The tax credit program allows New Hampshire businesses to use their state tax dollars to support local projects that they care about.

Donations are eligible for treatment as a federal charitable contribution, increasing tax efficiency of a gift to near 90%, depending on the business and its unique tax situation

CDFA reviews many project applications each year, and awards tax credits to those they determine are feasible and will make the biggest impact on economic development in the state. Visit nhcdfa.org for more information.

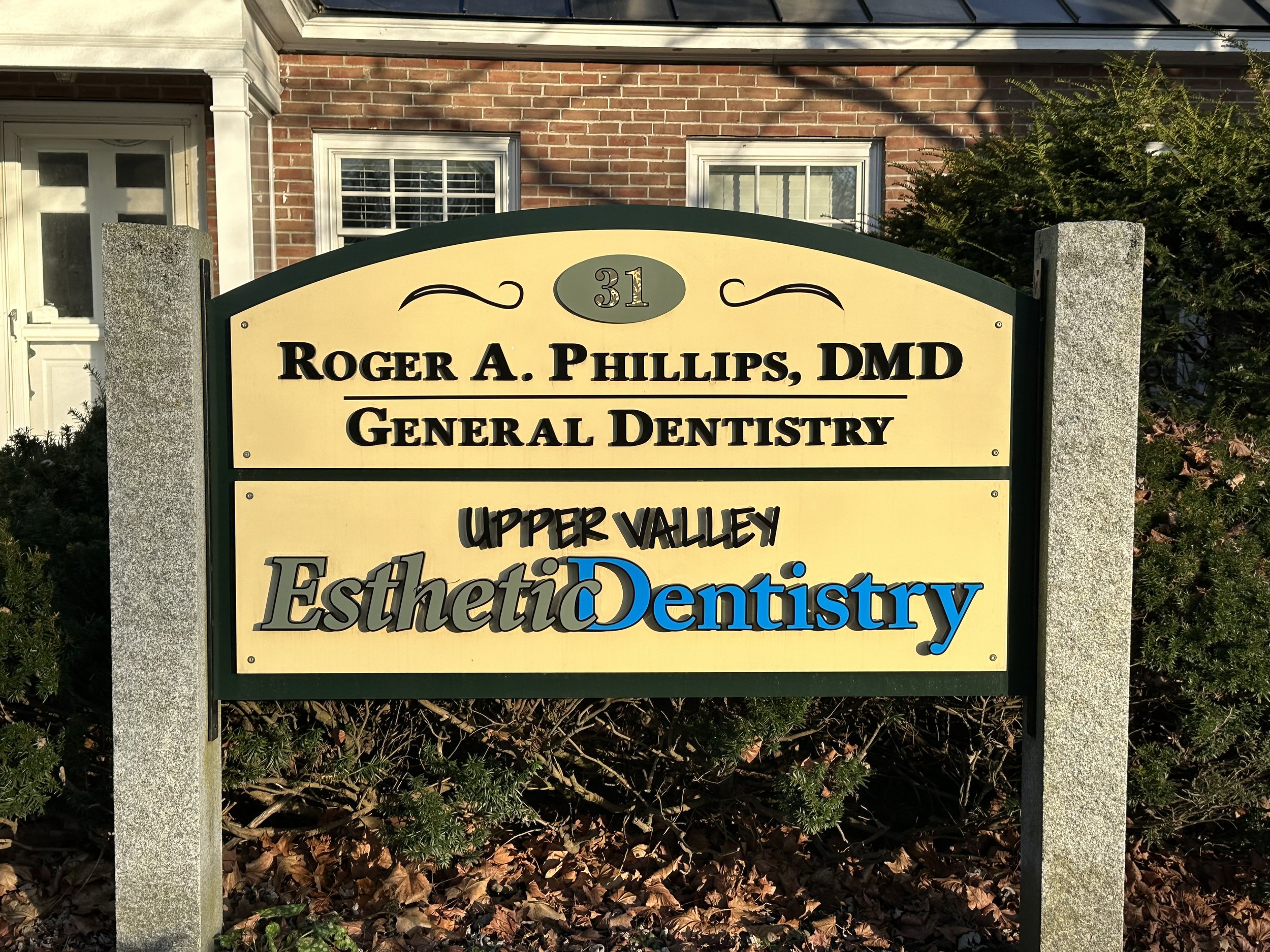

Thank you to the businesses that made their commitment to support this project!

How Do the Tax Credits Work?

CDFA administers the tax credit program. Many project applications are reviewed each year and tax credits are awarded to those it determines are feasible and will make the biggest impact on economic development in New Hampshire.

Any NH business that contributes business profit tax, business enterprise, or insurance premium taxes to the state may support a CDFA tax credit project. The program allows a business to contribute to projects of its choice; the business then receives a NH state tax credit worth 75% of their contribution. The credit can be used over a period of five years to reduce the business’ state tax liability. The remaining 25% of the contribution may also be used to reduce business profits tax. The remaining amount may also be eligible for treatment as charitable contribution.

Example, $10,000 Contribution from Business

NH State Tax Credit, $7,500

NH Business Profits Tax, $770

Federal Tax, $525

Total State Tax Credit, $8,795